Thrift

Savings just got more secure

The problem Thrift solves

We will start with what a thrift is and how the traditional thrift institution works from there. Lastly, we will look at the smart contract that mimic the behavior of a thrift institution and possible functionalities that can be included later on.

Thrift is an informal savings and lending mechanism prevalent in many African countries. These informal systems often involve community-based savings groups, rotating savings and credit associations (ROSCAs), or microfinance institutions that cater to the needs of underserved populations. These mechanisms are sometimes referred to as "thrift societies" or "savings clubs."

In these systems, individuals pool their savings together and take turns receiving lump-sum amounts from the collective pool. This enables members to access funds for various purposes, such as starting a small business, paying for education, or addressing emergency expenses. These informal savings and lending practices serve as an important source of financial support and social cohesion within communities, particularly in areas where formal banking services may be limited. An example of thrift institution is farmers coming together to create a saving club where any member of the club can save together, access fund from the group to buy farm inputs or to respond to an emergency like disease outbreak on the farm.

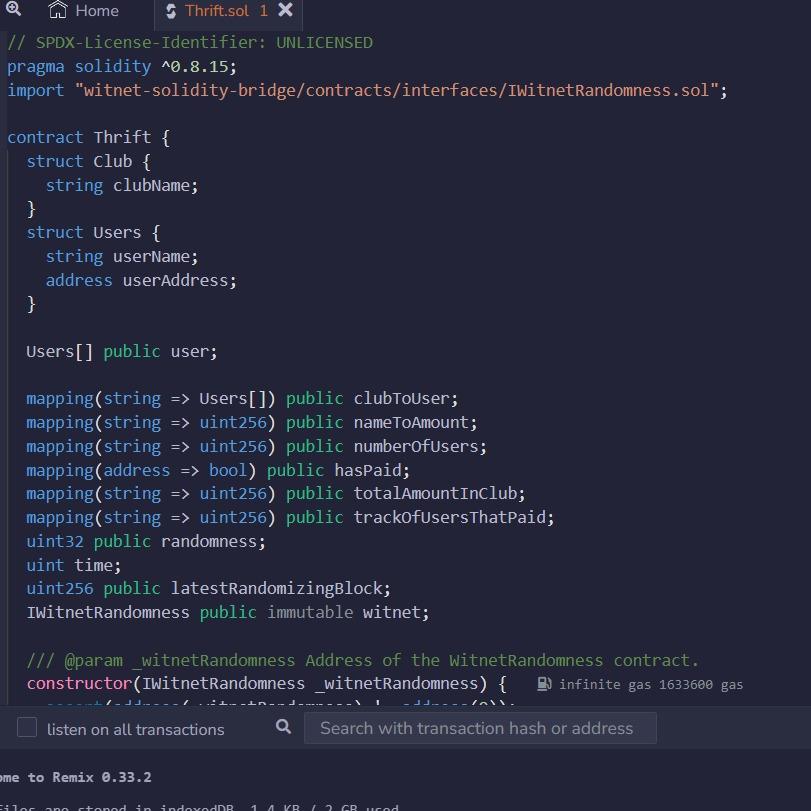

Technologies used

Cheer Project

Cheering for a project means supporting a project you like with as little as 0.0025 ETH. Right now, you can Cheer using ETH on Arbitrum, Optimism and Base.