DeFi Asset Management Platform

The objective is to build a non-custodial platform for investors to create, purchase and manage tokenized assets in the form of smallcases on Blockchain.

Created on 14th May 2022

•

DeFi Asset Management Platform

The objective is to build a non-custodial platform for investors to create, purchase and manage tokenized assets in the form of smallcases on Blockchain.

The problem DeFi Asset Management Platform solves

DeFi Asset Management Platform

The objective is to build a non-custodial platform for investors to create, purchase and manage tokenized assets in the form of smallcases. There will be portfolios/smallcases with different asset classes managed on DeFi (Decentralized Finance). Each portfolio is basically a bundle of existing DeFi protocols/crypto assets, Gold, Real Estate assets represented as ERC20 Token on native Blockchain. The platform will automate the process of rebalancing of assets.

A trustless autonomous Smart Contract will hold custody to the underlying tokens of the smallcase. The platform automates the process of rebalancing and redemption of assets via bots which will rebalance components of a portfolio to optimal allocation based on investor's preferences and market conditions. These bots essentially execute the strategies implemented in Solidity Smart Contracts.

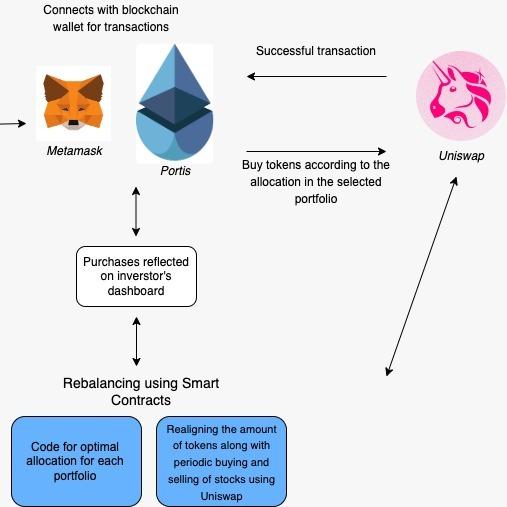

The UI will be developed using React with Javascript. Users can sign in to the Defi Dashboard using Portis/MetaMask wallet, Ledger wallet, which is a hardware wallet, or a combination of MetaMask and Ledger wallet, ensuring the security of cold storage with the convenience of hot wallet.

Smallcases will yield different risk-reward returns depending on their categories - conservative, moderate, aggressive (For example - A portfolio having higher percentage of Gold/Real Estate assets compared to Cryptos can be treated as a conservative one) and users can select one according to their risk tolerance.

Once the user finalizes and selects a portfolio their Portis/Metamask wallet will ask for transaction confirmation, following which the tokens will be transferred.

The transaction will be mined through Solidity Smart Contract which will redirect to Centralized (requiring KYC/AML) or Decentralized Exchanges/liquidity pools like Uniswap to purchase or sell tokens according to the allocation in the selected smallcase. Upon successful completion of the transaction, the purchases will be refle

Challenges we ran into

In future we plan to use Crypto Vaults instead of crypto wallets since vaults are not connected to the network and therefore are more secure.

It was tough to brainstorm about rebalancing algorithms given the volatility of token prices.

Setting up criteria to create smallcases and categorize them into: conservative, moderate, and aggressive.

Integration of different Smart Contracts.